Wednesday, April 20, 2011

Introductions

Well it's day one, so I think it's best to start off with some introductions.

For the sake of anonymity (and because I can) you can call me Marlee. I'm a college student, pursuing my Master's in Counseling, as well as finishing my Bachelor's in Nutrition. I take at least 12 credits or more a semester, as well as work 40 hours a week.

I live with my boyfriend, who's an assistant baseball coach with a monthly income of roughly $1,000 (can anyone say, sugardaddy?) and a roommate. I own 4 cats thanks to a stint of volunteering at the local animal shelter where I couldn't handle the thought of them being euthanized, so they ended up coming home with me permanently. Needless to say I lasted there for about a month.

My monthly bills (groceries, utilities, gas, etc) come to about $825. My monthly income? About $1,200. Any extra gets saved for school (which is an average of $5,000 per semester, not including textbooks).

And I'm broke.

Beyond broke, really. I budget my income to the exact dollar, and I have to say; it's depressing. Since increasing my income is not really an option (graduate students don't qualify for grants, so it's student loans, scholarships, or nothing at this point), I have decided I have no choice but to decrease the amount of money I spend each month. And before you even think it, just know that Mommy and Daddy have never lent me a cent. Even the idea of asking makes my blood curdle.

So some goals of mine?

#1:Finish School

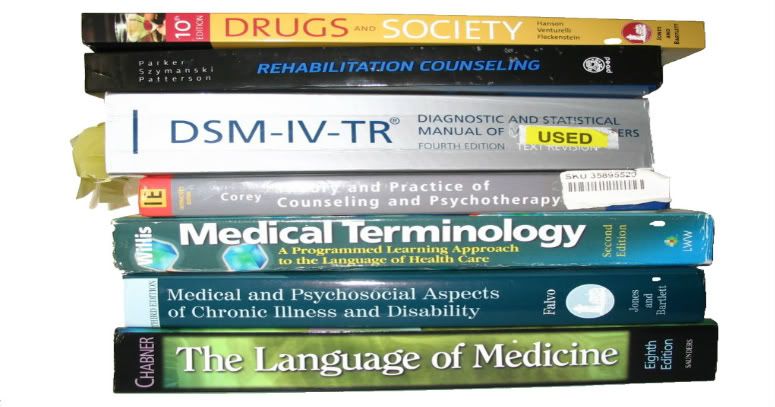

I have quite a few semesters left to finish, and I'm done taking out student loans. I'm studying to be a nutritional counselor for crying out loud, and last time I checked nutritional counselors didn't make the amount of money that allows them to pay back student loans equivalent to those doctor's and lawyers owe.

I need to find a way to pay for textbooks, juggle class, labs, work, and (hopefully) play without resorting to signing my life away to yet another loan. No interest while you're in school? Fantastic! And when I'm done? Ha! Lets just say banks salivate at the sight of my graduation date.

#2: Eat

As I said, I am also a nutrition major, working on becoming a registered dietitian. Therefore, the classic "Just cut coupons!" line just isn't going to cut it. I know I can probably wrangle up a crateful of ramen noodles at $0.14 /crate, but the fact is I'm not willing to eat like that.

So you guessed it, I want to eat real food, on a budget. I want fresh fruit, fresh vegetables, healthy dairy, lean meats and whole grains...all of it. Yes I'm broke, but someday when I'm inevitably homeless and doing magic tricks on the street corner, someone is going to say to me, "Well at least you've got your health," and I want to be able to agree with them.

#3: Shop

Oh yes, we are going for full-on delusional here. I mean come on, I'm 26, a girl, and a sucker for a great pair of sky-high heels.I don't need designer, just something that doesn't look like I'm still wearing hand-me-downs from some long lost Aunt.

For example, two weeks ago I found the cutest little bird necklace online at Forever21 for $1.50. That's right, $1.50. Free shipping. That's what I'm talkin' about!

#4: Save

I know this should probably be higher on the list, so we'll pretend this list isn't yet prioritized (eating and shopping at a higher priority than saving? Nah....). But the fact is, someday my car ('93 Plymouth Duster, with partially working parts), is going to go to the special farm where Dodsons and Gremlins race through open fields, and I'm going to need some other form of transportation. Not to mention all those other things like health insurance, owning a home one day, or hell maybe I want to try sushi before I die.

Anyway, I need to save a little something every month, and I've got to figure out a way to do it.

So this will be my diary. My crude attempt to find some ways to save money in my current situation.

Comments are appreciated!

Subscribe to:

Post Comments (Atom)

Include the savings amount in your budget.

ReplyDeletex% for food

X% for clothing

X% for saving

X% for medical insurance

You see where I'm going?

Food and clothing expenses can be adjusted a bit if necessary, savings and insurance never.

Trust me, I'm almost 60 and STILL broke.

Well done! Sounds like an interesting ride and a GREAT way to hold yourself responsible! I'm a Grad. student too, 1 year married and 24. I totally know how you feel! I'm excited to watch you work through this because I'm sure you can =]

ReplyDeleteThanks for your comment on my site! I love your budgeting ideas. Also love your advice to stand your ground -- I just read your other post about scoring a free red bell pepper. :D I've been out of school for almost nine years and every time I think about grad school, I balk. The thought of Sallie Mae rubbing its greedy hands together as they attempt to extract more blood from a turnip is just horrifying. Who needs Saw II, III, and XII when the true horror is receiving an email about your loan payment that includes the word "default"? Good luck to you! :)

ReplyDeleteThanks for the advice all!

ReplyDeleteRiver: Right now I bank at Well Fargo (not crazy about them in the least) but one thing they do have positive is online banking that allows me to budget so much for each category. Which I'm failing at keeping...maybe I should post how my budget is set up and see what you all think?

J.E. Raley: We are in the same situation friend! I hope through my ups and downs you can avoid some of the mistakes I'm sure I'll make!!

Maxine: I completely understand the graduate school fear! I have $3800 in savings, and my bill for summer school just came in the mail: $3700. Ouch. Thanks for sending the luck my way!

I totally love your blog. Good ideas with adequate amounts of humor to keep me reading! One really good suggestion for your book buying links is: betterworldbooks.com

ReplyDeleteCheclk them out!

vizslame: Thank you! And great site suggestion by the way! I added a link for them on the side of my page!

ReplyDeleteOK...obviously you can budget and I can't. Can I just give you my money every month and you just give me an allowance? Then maybe I can actually afford to finish my education.....

ReplyDeleteOh yeah, the typical money saving food just isn't even worth it. I figure whatever you originally saved by eating crap, you make up for in medical bills down the road.

ReplyDeleteHa! I like this blog very much. Especially your free red pepper.

ReplyDeleteI left university after my MA because I didn't want to be broke anymore -I had a strange idea that I could work and maybe one day afford to go futher with my studies but for now I'd like to be able to pay rent AND eat.

That was in 2006. Right now I am living in Milan and still on a to-the-euro budget. Admittedly it's more down to the economic crisis than anything else, but that doesn't make it any easier.

I wish you all the best on your journey and hope you find 20 dollars on the street. When you find money blowing down the road it makes the day so much sweeter.

Oh, how I wish I had your courage! But I'm a complete conflict-avoidance person who would rather pay extra than initiate a "scene". Which is probably why I always feel ripped off when I go shopping, even when I'm trying to only buy things that are really on sale. And why I can't keep a budget to save my life. I wish you well on your journey, and look forward to reading about your success, both materially and educationally!

ReplyDelete